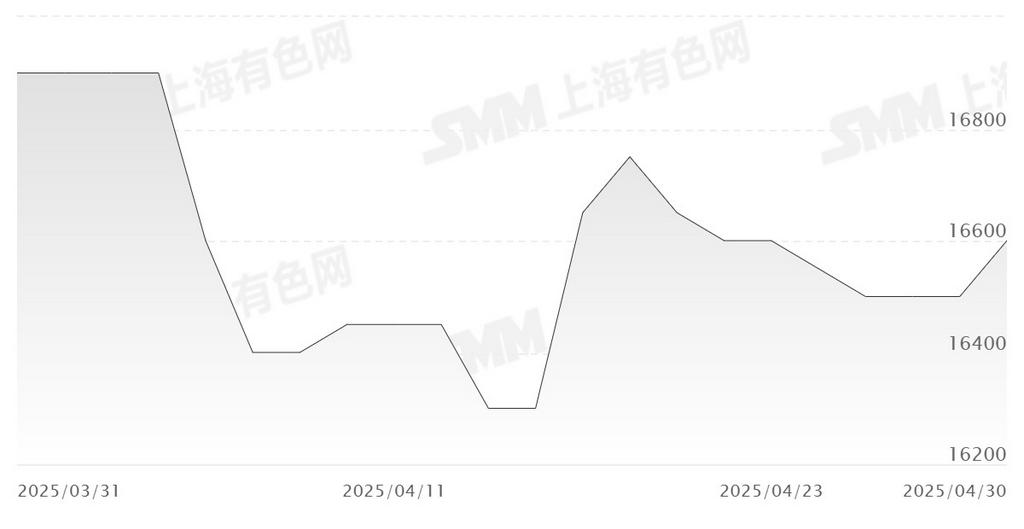

This month, magnesium ingot prices maintained a fluctuating rangebound trend.

Overview of Magnesium Ingot Production

According to SMM data, China's primary magnesium production decreased by 4.9% MoM in April 2025, while magnesium ingot production decreased by 5.5% MoM.

Domestic magnesium ingot producers experienced varying degrees of production increases and decreases during the month. Overall, the country's magnesium ingot production decreased MoM. The decrease in production this month was mainly attributed to the following three reasons: Firstly, magnesium ingot prices fell below the break-even point in March. Under the pressure of losses, some magnesium ingot smelters conducted maintenance in March, affecting primary magnesium production in April. Secondly, magnesium plants were impacted by environmental protection factors such as the storage sites for magnesium slag solid waste. Two magnesium ingot smelters in Shaanxi were affected and conducted maintenance and rectification. Thirdly, two magnesium ingot smelters conducted maintenance or suspended production due to sudden production issues, resulting in production cuts of 1,600 mt in April. The increase in production this month was mainly due to the following reasons: As magnesium prices surged past the 16,000 yuan threshold at the end of March, magnesium ingot transaction prices fluctuated rangebound within 16,300-16,800 yuan/mt in April. The profit margins of magnesium ingot smelters were effectively restored, and enterprises that had previously conducted maintenance gradually resumed production.

Currently, magnesium ingot smelters in the main production areas have reported production resumption plans for May, but specific resumption times have not been determined. SMM will continue to monitor the situation. Overall, domestic magnesium ingot smelter production is expected to increase in May, with primary magnesium production possibly rising by 4.2% MoM.

Overview of Magnesium Alloy Production

SMM data indicates that China's magnesium alloy production increased by 14.7% MoM in April 2025, with a significant increase in the operating rate of magnesium alloy enterprises during the month.

Domestic magnesium alloy producers experienced expected production increases during the month. The increase in production this month was mainly attributed to the following three reasons: Firstly, affected by the Sino-US tariff war, Chinese enterprises may exhibit a significant "rush to export" phenomenon. That is, during the window period from the announcement to the official implementation of the tariff hike product list, enterprises ship goods in advance to avoid higher future tariffs. Therefore, this phenomenon temporarily pushed up magnesium alloy production data in April, resulting in phased growth. Secondly, March and April are the peak seasons for downstream magnesium alloy die-casting plants, and magnesium alloy orders increased significantly due to the peak season. With new capacity coming online at magnesium alloy enterprises in April, magnesium alloy production is expected to increase slightly in May.